International Business

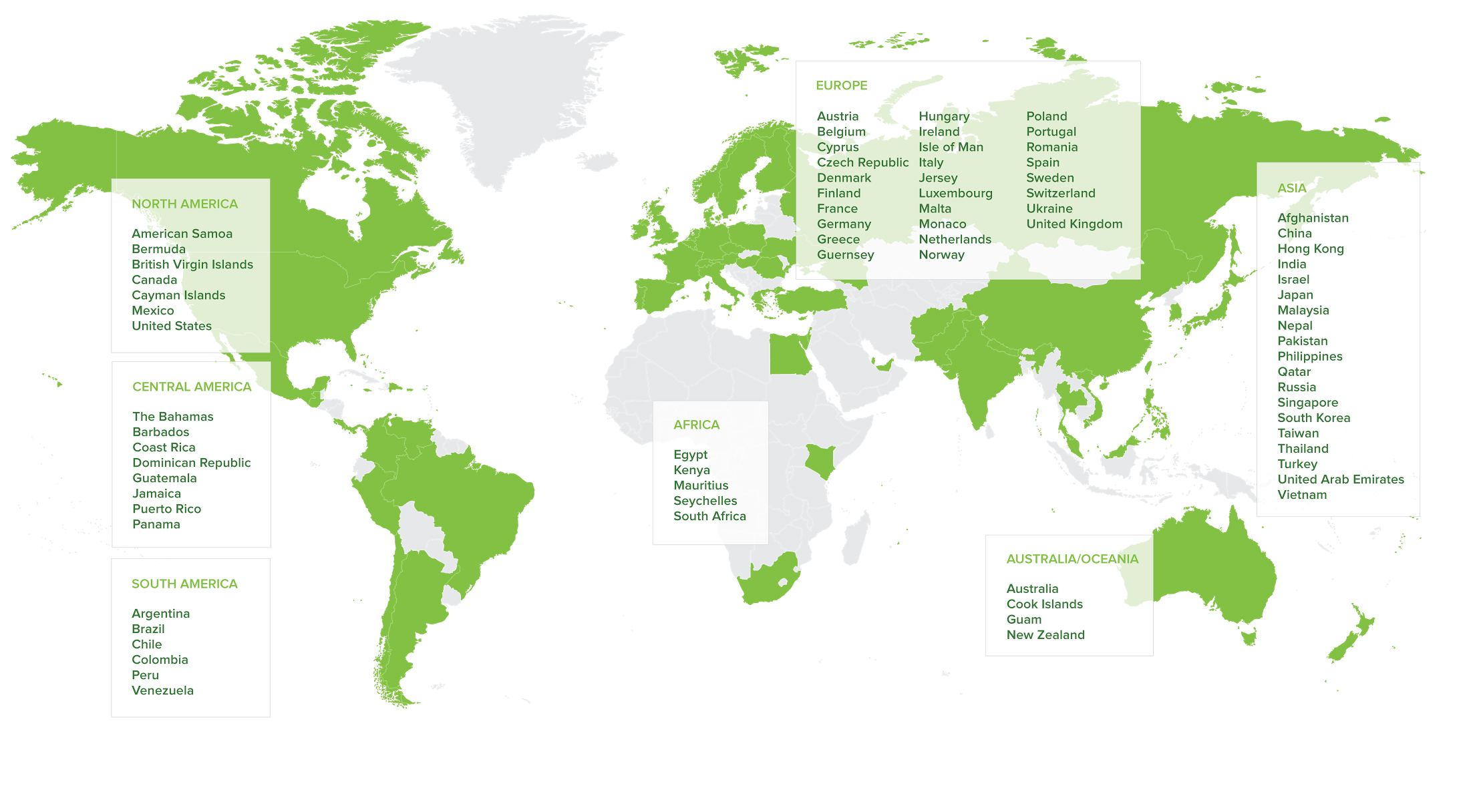

HPG has served client needs in the following jurisdictions throughout the world.

Whether you are expanding your U.S. company’s operations internationally, or are a foreign company considering expanding outside of your current jurisdiction, you are faced with complex business and tax structuring questions. HPG’s International Team is poised to help answer your international business questions and provide proactive solutions to ensure that your inbound or outbound plans efficiently lay a foundation for you to reach success.

In addition to our Raleigh-based team, our affiliation with Crowe Global gives us additional breadth with resources in local country jurisdictions, as well as personal relationships with our peers throughout the world. With regional point people, the service delivery model is similar to the one that our clients have come to know, where access to the team is simple and response time is short. Thus, similar to the national firms, HPG is able to provide resources in jurisdictions throughout the world and coordinate those services efficiently and cost-effectively to meet our clients’ needs.

As your company grows internationally, you need a partner who can nimbly assemble the resources you need to make good business decisions and comply with the related compliance obligations and administration.

We can provide resources to assist with areas such as:

Compliance and Consulting

- Inbound and outbound investments

- U.S. tax compliance related to foreign operations and activities

- Statutory audit and tax requirements in foreign jurisdictions

- Inpatriate and expatriate tax compliance and consulting services

- Consulting and compliance related to withholding tax and tax treaty positions

Structuring

- Planning for business facilitation and tax efficiency

- Global structure implementation, including solutions for documentation requirements

- Maintenance of the structure with same service team used in implementation

Transfer Pricing

- Consulting regarding requirements under IRC Section 482

- Cost-effective solution to meeting contemporaneous documentation requirements